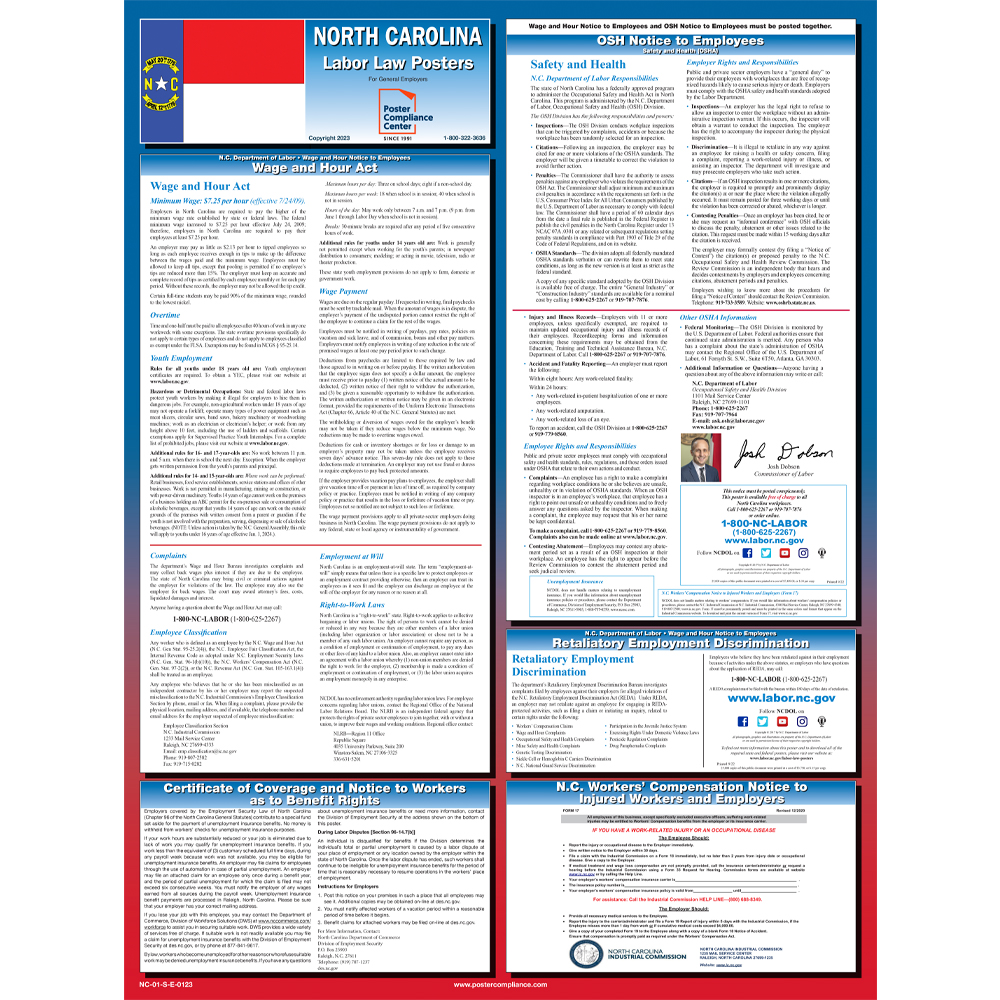

North Carolina Labor Law Poster

- Buy North Carolina Labor Law Poster |

- Updates & Posting Requirements |

- Description

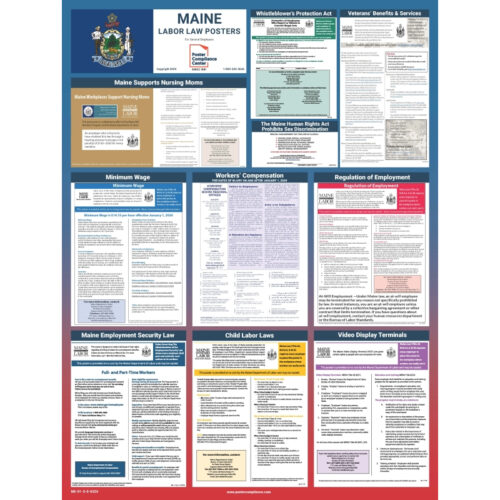

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty

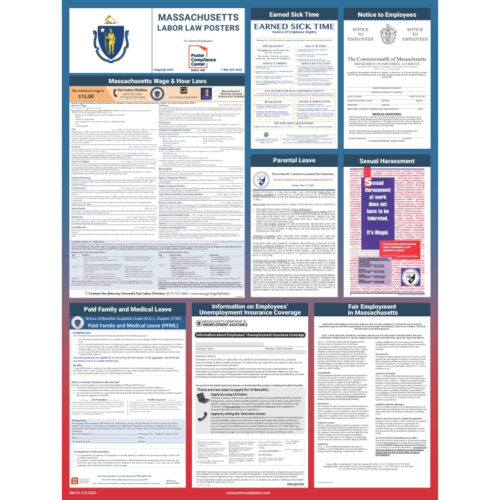

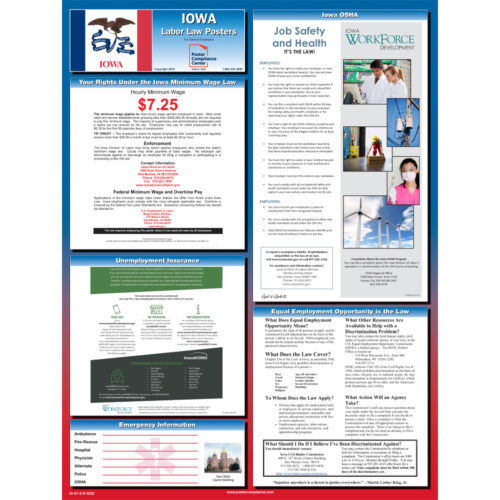

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty

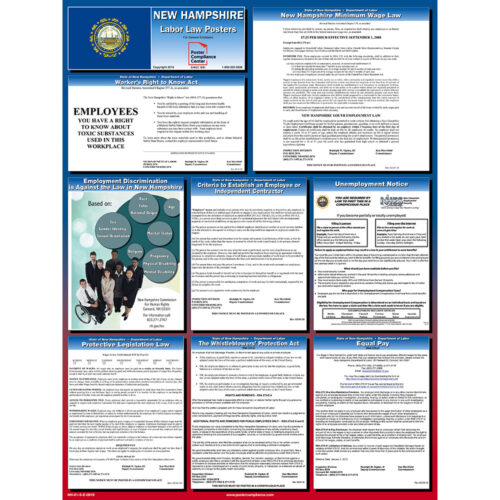

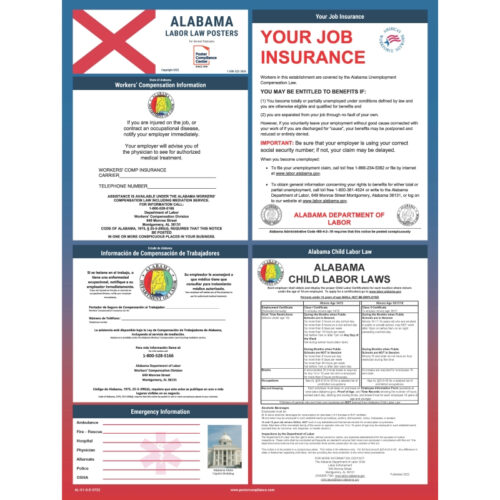

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty

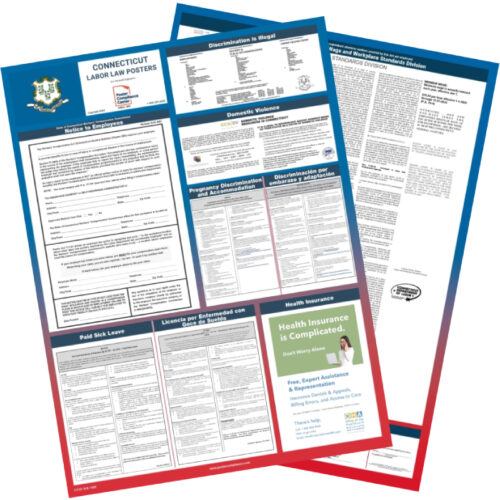

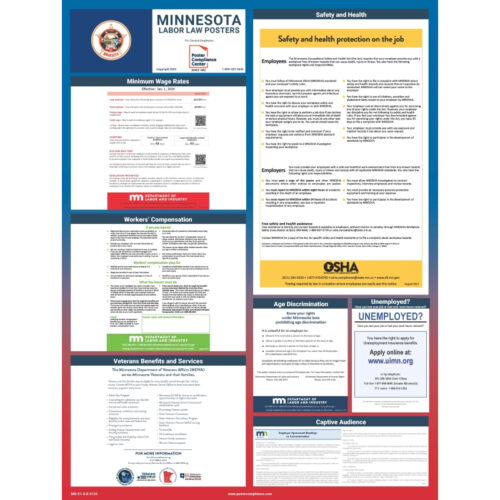

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty

All mandatory state and federal poster requirements

Live customer service

Federal & State posting regulation letter

Free updates for one year

$41,000 Violation Warranty