Federal, State, and Local Wage Laws in the United States

In the early 1900s, in the wake of the Industrial Revolution and the Great Depression, it was all too common for employers to expect their employees to work long hours for little pay. To address these oppressive working conditions, in 1938, the government passed the Fair Labor Standards Act (FLSA), which, among other things, set a living wage for employees.

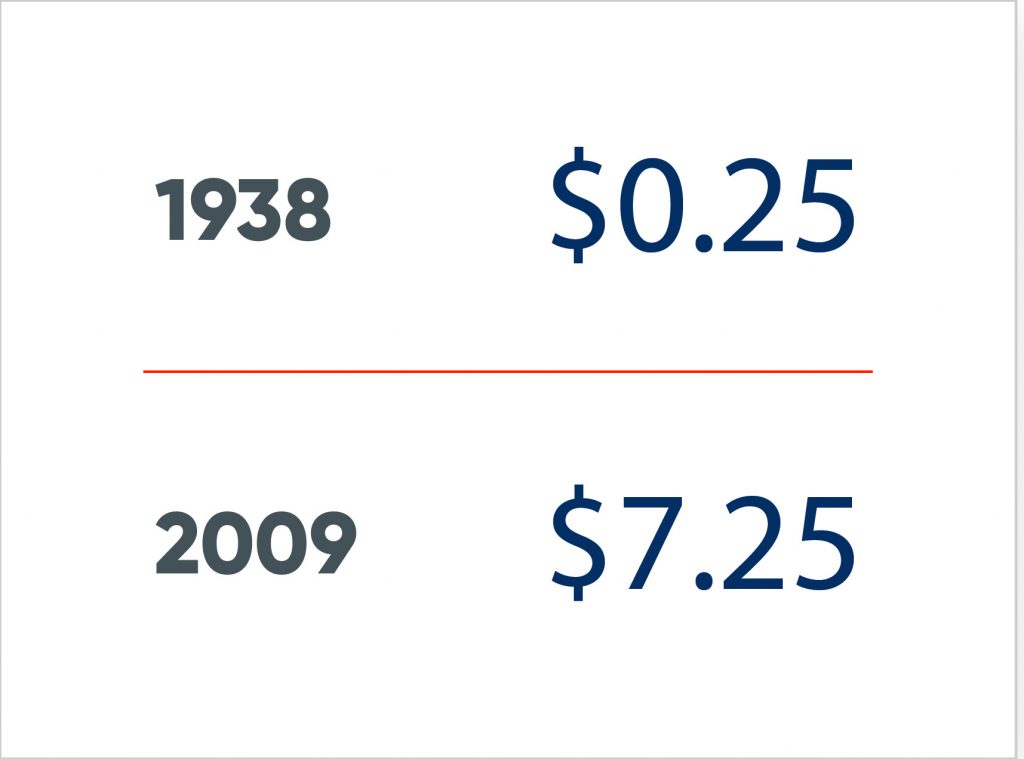

The first federal wage was $0.25 per hour. Today, nearly 30 amendments later, the rate is $7.25, set back in 2009. And states have gotten in on the action too, enacting their own minimum rates of pay.

Here’s what you need to know to ensure your company is in compliance with the latest wage laws.

Federal wage under FLSA

The FLSA requires employers to pay nonexempt (which generally means non-salaried employees) a wage of at least $7.25 per hour. The rule is slightly different for employees under 20 years old: for the first 90 days of their employment, they must be paid at least $4.25 an hour. The rule is also different for employees who receive tips: they are entitled to at least $2.13 per hour if they claim a tip credit. Some other employees can earn less than the statutory minimum wage: student learners; full-time students in retail or service establishments, agriculture, or institutions of higher education; and individuals whose earning or productive capacities are impaired by physical or mental disabilities, including those related to age or injury.

Additional state and local requirements

States and localities may also have adopted additional laws that regulate the wage for employees. In these states and cities, employers must follow the law with a higher standard. In other words, if state law requires a higher wage than the FLSA, then the employer must pay the higher wage.

Five states—Alabama, Louisiana, Mississippi, South Carolina, and Tennessee—don’t have their own minimum wage law. 29 states plus Washington, D.C., Guam, and the Virgin Islands, have a higher wage than $7.25.

Minimum Wage by State, Federal, City or County

| State | City/County | Minimum Wage |

|---|---|---|

| Alabama | $7.25 | |

| Alaska | $11.73 (effective 1/1/24) | |

| Arizona | $14.35 (non-tipped employees, effective 1/1/24) | |

| $11.35 (tipped employees, effective 1/1/24) | ||

| Flagstaff | $17.40 (most employees, effective 1/1/24) | |

| $15.40 (tipped employees, effective 1/1/24) | ||

| Tucson | $14.35 (effective 1/1/24) | |

| Arkansas | $11.00 (effective 1/1/21) | |

| California | $16.00 (effective 1/1/24) | |

| Alameda | $16.52 (effective 7/1/23) | |

| Belmont | $17.35 (effective 1/1/24) | |

| Berkeley | $18.07 (effective 7/1/23) | |

| Burlingame | $17.03 (effective 1/1/24) | |

| Cupertino | $17.75 (effective 1/1/24) | |

| Daly City | $16.62 (effective 1/1/24) | |

| East Palo Alto | $17.10 (effective 1/1/24) | |

| El Cerrito | $17.92 (effective 1/1/24) | |

| Emeryville | $18.67 (effective 7/1/23) | |

| Foster City | $17.00 (effective 1/1/24) | |

| Fremont | $16.80 (effective 7/1/23) | |

| Half Moon Bay | $17.01 (effective 1/1/24) | |

| Hayward | $16.90 (large businesses with 26+ employees, effective 1/1/24) | |

| $15.50 (small businesses with 1-25 employees, effective 1/1/24) | ||

| Los Altos | $17.75 (effective 1/1/24) | |

| Los Angeles | $16.78 (26 or more employees, effective 7/1/23) | |

| $16.78 (25 or fewer employees or approved non-profit corporations with 26 or more employees, effective 7/1/23) | ||

| Los Angeles County | $16.90 (effective 7/1/23) | |

| Malibu | $16.90 (All employers, effective 7/1/23) | |

| Menlo Park | $16.70 (effective 1/1/24) | |

| Milpitas | $17.20 (effective 7/1/23) | |

| Mountain View | $18.75 (effective 1/1/24) | |

| Novato | $16.86 (Very Large businesses 100+ employees, effective 1/1/24) | |

| $16.60 (Large businesses 26-99 employees, effective 1/1/24) | ||

| $16.04 (Small businesses 1-25 employees, effective 1/1/24) | ||

| Oakland | $16.50 (effective 1/1/24) | |

| Palo Alto | $17.80 (effective 1/1/24) | |

| Pasadena | $16.93 (effective 7/1/23) | |

| Petaluma | $17.45 (All employers regardless of size, effective 1/1/24) | |

| Redwood City | $17.70 (effective 1/1/24) | |

| Richmond | $17.20 (effective 1/1/24) | |

| San Carlos | $16.87 (effective 1/1/24) | |

| San Diego | $16.85 (effective 1/1/24) | |

| San Francisco | $18.07 (effective 7/1/23) | |

| San Jose | $17.55 (effective 1/1/24) | |

| San Mateo County | $17.06 (effective 1/1/24) | |

| San Mateo | $17.35 (effective 1/1/24) | |

| Santa Clara | $17.75 (effective 1/1/24) | |

| Santa Monica | $19.73 (All Hotels, effective 7/1/23) | |

| $16.90 (All businesses, effective 7/1/23) | ||

| Santa Rosa |

$17.45 (All employers regardless of size, effective 1/1/24) |

|

| Sonoma | $17.60 (26 or more employees, effective 1/1/24) | |

| $16.56 (25 or fewer employees, effective 1/1/24) | ||

| South San Francisco | $17.25 (effective 1/1/24) | |

| Sunnyvale | $18.55 (effective 1/1/24) | |

| West Hollywood | $19.08 (Hotel Workers, effective 7/1/23) | |

| $19.08 (All employers, effective 7/1/23) | ||

| Colorado | $14.42 (most employers, effective 1/1/24) | |

| $11.40 (tipped workers, effective 1/1/24) | ||

| Denver | $18.29 (most employees, effective 1/1/24) | |

| $15.27 (tipped workers, effective 1/1/24) | ||

| Connecticut | $15.69 (effective 1/1/24) | |

| Delaware | $11.75 (effective 1/1/23) | |

| District of Columbia | $17.00 (employees who do not receive gratuities, effective 7/1/23) | |

|

$6.00 (employees who receive gratuities, effective 5/1/23) $8.00 (employees who receive gratuities, effective 7/1/23) |

||

| Florida | $12.00 (effective 9/30/23) | |

| $8.98 (tipped employees, effective 9/30/23) | ||

| Georgia | $5.15 (Basic Minimum Rate, 6 or more employees) | |

| $7.25 (Employers subject to Fair Labor Standards Act) | ||

| Hawaii | $14.00 (effective 1/1/24) | |

| Idaho | $7.25 (effective 10/1/12) | |

| Illinois | $14.00 (effective 1/1/24) | |

| $8.40 (tipped workers, effective 1/1/24) | ||

| $12.00 (youth workers working fewer than 650 hours per year, effective 1/1/24) | ||

| Chicago | $15.80 (Large employers, effective 7/1/23) | |

| $15.00 (Small employers, effective 7/1/23) | ||

| $9.48 (tipped workers of large employers, effective 7/1/23) | ||

| $9.00 (tipped workers of small employers, effective 7/1/23) | ||

| Cook County | $14.00 (effective 1/1/24) | |

| $8.40 (tipped workers, effective 1/1/24) | ||

| Indiana | $7.25 | |

| Iowa | $7.25 | |

| Kansas | $7.25 | |

| Kentucky | $7.25 | |

| Louisiana | $7.25 | |

| Maine | $14.15 (non-tipped employees, effective 1/1/24) | |

| $7.08 (tipped employees, effective 1/1/24) | ||

| Portland | $15.00 (non-tipped employees, effective 1/1/24) | |

| $7.50 (tipped employees, effective 1/1/24) | ||

| Maryland | $13.25 (large employers, effective 1/1/23) | |

| $12.80 (small employers, effective 1/1/23) | ||

| $3.63 (tipped employees, effective 1/1/23) | ||

| $15.00 (large employers, effective 1/1/24) | ||

| $15.00 (small employers, effective 1/1/24) | ||

| Howard County | $15.00 (government employees, effective 7/1/22) | |

| $15.00 (employers, effective 1/1/23) | ||

| $13.25 (small employers, effective 1/1/23) | ||

| Montgomery County | $16.70 (51 or more employees, effective 7/1/23) | |

| $15.00 (11-50 employees, effective 7/1/23) | ||

| $14.50 (1-10 employees, effective 7/1/23) | ||

| Massachusetts | $15.00 (effective 1/1/23) | |

| $6.75 (tipped workers, effective 1/1/23) | ||

| Michigan | $10.33 (most workers, effective 1/1/24) | |

| $3.93 (tipped workers who make at least $6.40/hour in tips, effective 1/1/24) | ||

| $8.78 (minors aged 16-17 can be paid 85% of the minimum wage; effective 1/1/24) | ||

| $4.25 (training wage, may be paid to workers aged 16 to 19 for the first 90 days of employment) | ||

| Minnesota | $10.85 (Large employer: annual gross revenue of $500K+, effective 1/1/24) | |

| $8.85 (Small employer: annual gross revenue less than $500K, effective 1/1/24) | ||

| $8.85 (Youth wage: may be paid to employees aged 17 or younger, effective 1/1/23) | ||

| $8.85 (Training wage, effective 1/1/23) | ||

| $8.85 (J-1 Visa, effective 1/1/23) | ||

| Minneapolis | $15.57 (100 or more employees, effective 1/1/24) | |

| $15.57 (100 or fewer employees, effective 7/1/24) | ||

| Saint Paul | $15.57 (10K or more employees & city employees, effective 1/1/24) | |

| $15.19 (10K or more employees & city employees, effective 7/1/23) | ||

| $15.57 (between 101 and 10K employees, effective 7/1/24) | ||

| $15.00 (between 101 and 10K employees, effective 7/1/23) | ||

| $14.00 (6-100 employees, effective 7/1/24) | ||

| $13.00 (6-100 employees, effective 7/1/23) | ||

| $12.25 (5 or fewer employees, effective 7/1/24) | ||

| $11.50 (5 or fewer employees, effective 7/1/23) | ||

| Mississippi | $7.25 | |

| $6.16 (Youth/Student Wage up to 20hrs/per week) | ||

| $4.25 (Training wage) | ||

| Missouri | $12.30 (private employees, effective 1/1/24) | |

| $6.15 (tipped workers, effective 1/1/24) | ||

| Montana | $9.20 (effective 1/1/22) | |

| Nebraska | $10.50 (effective 1/1/23) | |

| Nevada | $11.25 (employees who do not receive health benefits, effective 7/1/23) | |

| $10.25 (employees who receive health benefits, effective 7/1/23) | ||

| New Hampshire | $7.25 (effective 3/1/14) | |

| New Jersey | $18.13 (long-term care facility direct care staff members, effective 1/1/24) | |

| $15.13 (most employers, effective 1/1/24) | ||

| $13.73 (Seasonal and Small Employers – fewer than 6, effective 1/1/24) | ||

| $12.81 (Agricultural Employers w/fewer than six employees, effective 1/1/24) | ||

| $5.26 (tipped workers, effective 1/1/24) | ||

| New Mexico | $12.00 (effective 1/1/23) | |

| $3.00 (tipped employees, effective 1/1/23) | ||

| Albuquerque | $12.00 (without medical/childcare benefits, effective 1/1/23) | |

| $12.00 (with medical/childcare benefits, effective 1/1/23) | ||

| $7.20 (tipped worker, effective 1/1/23) | ||

| Bernalillo County | $12.00 (effective 1/1/24) | |

| Las Cruces |

$12.36 (most employees, effective 1/1/24) |

|

|

$4.95 (tipped employees, effective 1/1/24) |

||

| Santa Fe | $14.60 (effective 3/1/24) | |

| Santa Fe County | $14.60 (effective 3/1/24) | |

| $3.88 (base wage for tipped employees, effective 3/1/22) | ||

| New York | $16.00 (employers in New York City, effective 1/1/24) | |

| $16.00 (Employers in Long Island and Westchester County, effective 1/1/24) | ||

| $15.00 (Remainder of the state, effective 1/1/24) | ||

| North Carolina | $7.25 | |

| $2.13 (base wage for tipped employees, effective 1/1/20) | ||

| North Dakota | $7.25 | |

| Ohio | $10.45 (non-tipped employees, effective 1/1/24) | |

| $5.25 (tipped employees, effective 1/1/24) | ||

| Oklahoma | $7.25 | |

| Oregon | $14.20 (Standard, effective 7/1/23) | |

| Portland | $15.45 (Portland Metro, effective 7/1/23) | |

| $13.20 (Nonurban Counties, effective 7/1/23) | ||

| Pennsylvania | $7.25 | |

| Rhode Island | $14.00 (all other employees, effective 1/1/24) | |

| $12.60 (Students and certain non-profits, effective 1/1/24) | ||

| $10.50 (minors 14 to 15 working not more than 24 hours a week, effective 1/1/24) | ||

| $3.89 (tipped employees, effective 1/1/24) | ||

| South Carolina | $7.25 | |

| South Dakota | $11.20 (most employers, effective 1/1/24) | |

| $5.60 (tipped employees, effective 1/1/24) | ||

| Tennessee | $7.25 | |

| Texas | $7.25 | |

| Utah | $7.25 | |

| Vermont | $13.67 (most employers, effective 1/1/24) | |

| $6.84 (tipped employees, effective 1/1/24) | ||

| Virginia | $12.00 (effective 1/1/23) | |

| Washington | $16.28 (effective 1/1/24) | |

| $13.38 (minors under age 16, effective 1/1/23) | ||

| Seattle | $19.97 (large employers with 501+ employees, effective 1/1/23) | |

| $17.25 (Employers that pay toward medical benefits or employees who earn tips, effective 1/1/23) | ||

|

$19.97 (all other employees, effective 1/1/23) |

||

| Tukwila |

$20.29 (large employers with 501+ employees, effective 1/1/24) |

|

|

$18.29 (mid-size employers with 15+ employees or annual gross Tukwila revenue over $2 million, effective 1/1/2024) |

||

| West Virginia | $8.75 (effective 1/1/16) | |

| Wisconsin | $7.25 | |

| Wyoming | $5.15 | |

| $7.25 (employers subject to Fair Labor Standards Act) | ||

| Federal | $7.25 | |

| Federal Contractor |

$12.90 (employees whose contracts were entered between January 1, 2015, and January 29, 2022, effective 1/1/24) /$17.20 (employees whose contracts were entered on or after January 30, 2022, effective 1/1/24) |

|

Sign up for Free Labor Law Update Alerts.

How often does the federal wage increase?

There is no set schedule for the automatic increase of the minimum wage, whether at the federal, state, or local level. To raise the federal wage, Congress must pass a bill, and the president must sign it into law.

Similar legislative processes occur at the state and local levels. In 2019, 20 states raised their wage rate and required employers to notify employees of the new wage.

Sometimes state and local governments set an incremental yearly increase if they want to hit a particular target. California is expected to increase their minimum wage for all employers to $15.50 in 2023: the current rate for small employers is $14.00, and it’s $15.00 for large employers. The law in New York is even more detailed. For large and small employers in New York City, the current wage is $15.00. For Long Island and Westchester, the rate is $15.00, and the rest of the state is currently at $14.20.

Other states adjust their wages to match the rise in the cost of living. These inflation adjustments are generally smaller and may occur annually or less often. As an example, Florida and New Jersey both adjust their rates annually to account for inflation.

Additionally, 55 localities currently have their own minimum wage, including cities and counties in Arizona, California, Colorado, Florida, Illinois, Maine, Maryland, Minnesota, New Mexico, New York, Pennsylvania, and Washington.

Wage notices and posters

Employers must post a notice explaining the provisions of the FLSA and applicable state and local wage laws—and they must ensure that they have the latest version of that information posted at all times. Bookmark this page to stay up to date on changes in the wage at the federal, state, and local levels. And contact us if you need help navigating the complex requirements relating to posters about wage and hour laws.