It’s been a busy season for mandatory labor law poster updates! We are only halfway through 2024 and the realm of labor law has already witnessed some significant developments. As the most trusted resource for labor law poster compliance, we are committed to keeping you well-informed. Some states have already updated multiple notices just this […]

What Is a Labor Law Poster Code? Have labor laws changed in your state or region? If so, your business must display the most current labor law posters. A poster code is an alphanumeric SKU that lets businesses keep track of whether their labor law posters are current. Where to Find Your Poster Code Compliance […]

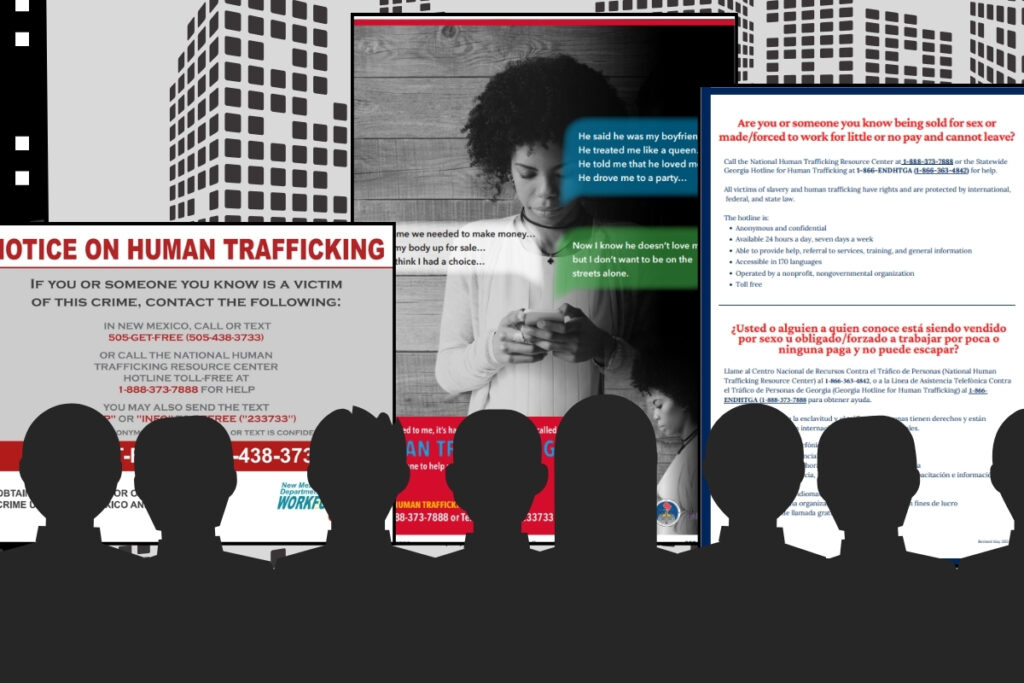

It’s important to understand the resources and regulations concerning Human Trafficking notices. U.S. Federal law defines human trafficking as the use of force, fraud, or coercion to compel a person into commercial sex acts or labor or services against his or her will. Since the TVPA was first introduced in 2000, it has been reauthorized […]

The move toward remote and hybrid work environments has created a series of headaches for employers, including how to share labor law posters with employees who aren’t in the workplace. Typically, labor law posters are displayed in common areas, such as employee breakrooms or lounges, where employees have ready access to them. But employees who […]

In 1948, the National Labor Relations Board (NLRB) ruled that employers could hold mandatory meetings on company property during work hours to address matters related to union organizing. Since then, these meetings, called “captive audience” meetings, have become a popular way for employers to express their viewpoint about union organizing and its impact to discourage […]

Know Your State Requirements updated February 2024 Are Breaks Required By Law? Every state has different laws on breaks for employees. Read below to learn more about rest, meal, and lunch break laws by state. State Break Requirements Meal Requirements Information Alabama Employees under the age of 16 must receive a 30-minute meal/rest break if […]

Staying compliant with labor laws is crucial for any business, but it’s especially challenging for companies with remote employees. Juggling different State and Federal regulations, managing posters and employee access, and keeping everyone informed can be a major headache. Enter eComply360, the game-changer for remote labor law compliance. This innovative solution streamlines the entire process, […]

What a ride 2023 has been! Maybe keeping up with labor law poster updates wasn’t on top of your to-do list. No stress, though – we’ve got your back in tracking those changes. Now’s the perfect moment to get in the loop on all the updates from the past year to stay compliant. And, it’s […]

Every employer should be aware of labor law poster compliance, even if it’s not a topic you want to spend much time on. To be compliant means meeting the requirements of properly posting current federal and state labor law posters for your employees. Many employers are choosing to subscribe to a poster compliance service, but what […]

After 30+ years as a reputable labor law poster provider, we’ve seen our fair share of unscrupulous business practices. With scare tactics, aggressive phone calls, and threatening mailers, a labor law compliance scam can lead well-meaning business owners to spend money on a labor law poster (or posters) that they don’t even need. Our ultimate […]

Adhering to labor law compliance regulations is crucial for employers to maintain a fair and legally compliant work environment while protecting the rights and interests of their employees. In this blog post, we will discuss essential best practices centered around labor law posters that organizations should follow to ensure they are in full compliance with […]

**Updated July 25, 2023** It’s been a busy season for mandatory labor law poster updates! We are only halfway through 2023 and the realm of labor law has already witnessed some significant developments. As the most trusted resource for labor law poster compliance, we are committed to keeping you well-informed. The Department of Labor (DOL) […]